Cook Insurance Services - Insuring North Carolina and South Carolina, Including Lumberton

Cook Insurance Services Provides Auto / Car Insurance, Home Insurance, and Business / Commercial Insurance to All of North Carolina and South Carolina, Including Lumberton

Danny Cook started Cook Insurance Services in 1999. Cook Insurance Services writes multiple lines of insurance in North Carolina and South Carolina, including Auto / Car Insurance, Home Insurance, and Business / Commercial Insurance.

Danny and his team have a combined 30+ years of experience. Danny holds the CIC (Certified Insurance Counselor) and CRM (Certified Risk Manager) designations, and is on the faculty of The National Alliance. Additionally, Danny holds a Masters in Risk Management and Insurance, and has been teaching various insurance classes since 2008.

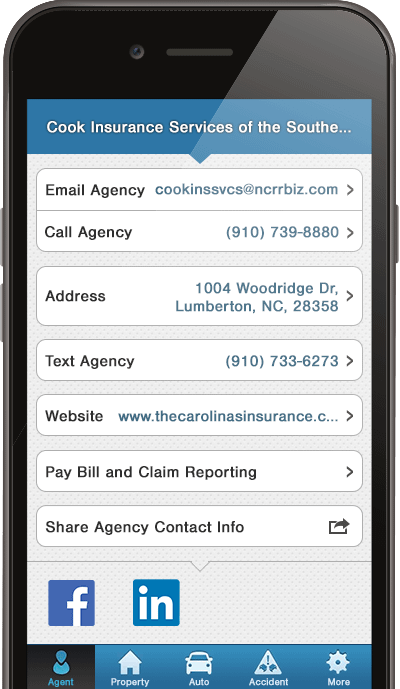

Cook Insurance Services strives to provide insurance programs to fit the client’s needs, and then exceed their expectations of service. Social media and the use of technology allows us to communicate with our clients beyond the “normal business hours”, when its most convenient for them.

If you are in the market for insurance, be sure to contact Cook Insurance Services today for a free quote!